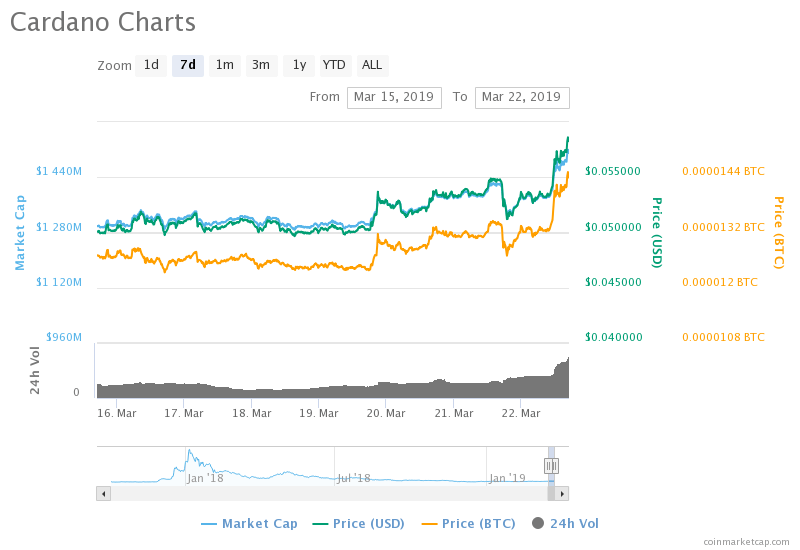

ADA, the native token of Cardano’s open-source blockchain project, has jumped 13.7-percent since Thursday’s mid-session.

At 1330 UTC, the ADA-to-dollar rate was trading at 0.058, up 7.33-percent on a 24-hour adjusted timeframe. Before that, the pair went through a frictionless upside move from an intraday low point near 0.052. After the bull flag formation, it walked horizontally for a brief during the early Asia session but picked up bullish momentum ahead of the European market open. Have a look:

CARDANO’S ADA TOKEN RISES 13.7% IN A DAY | SOURCE: COINMARKETCAP.COM

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Speaking of volumes: the ADA token changed hands worth $122.49 million in the last 24 hours, maximally against Tether’s stablecoin USDT, Bitcoin blockchain’s BTC and South Korea’s KRW. Exchanges that contributed the most to those trading volumes included ZBG, followed by Binance, Upbit, Huobi, and others.

ZBG appeared on CoinMarketCap.com’s radar first in October 2018 and quickly brought itself up to top ten daily volume platforms. Investigators believe that the exchange is neck-deep in faking its trading volumes, which could put the Cardano’s ongoing rally under a doubtful eye. In comparison, other top ADA-trading exchanges have a decent track record.

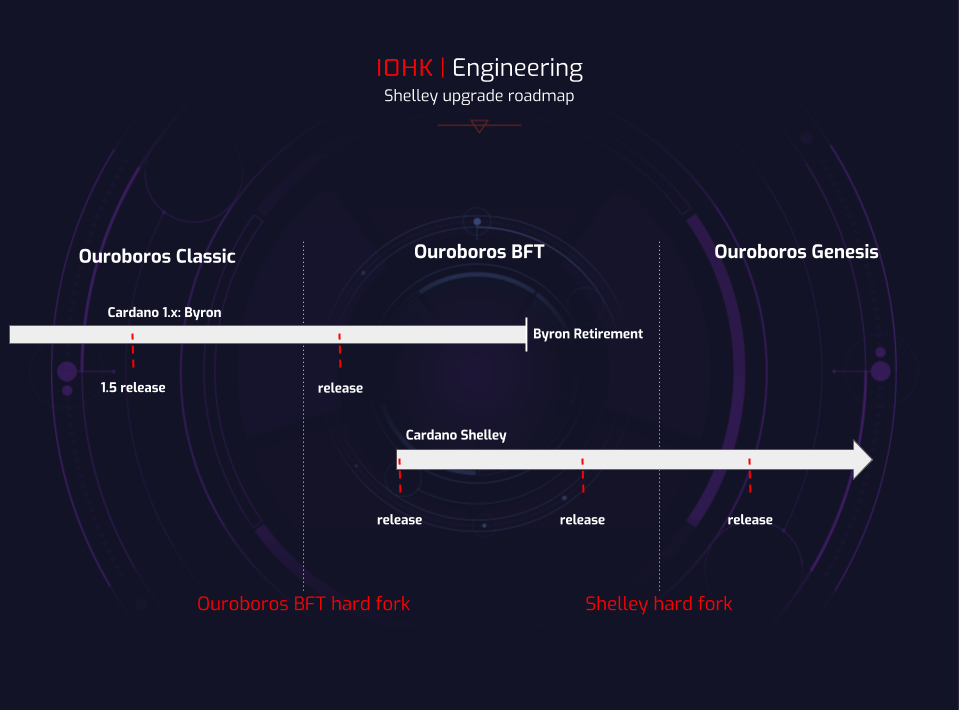

Mainnet Upgrade

Three hours after the ADA rally began, Cardano’s official Twitter handle issued a tweet discussing an issue in their latest mainnet release. Cardano 1.5 suffered a password spending issue, which was preventing users from spending ADA because the client was not asking for a spending password when a transaction is created.

An issue has been found in the latest release of Daedalus 0.13.0 (Cardano 1.5.0) which is affecting a small number of users. For more info please read this forum post: https://t.co/bd9vHT1ROc

— Cardano Foundation (@CardanoStiftung) March 21, 2019

The news had no direct relevance to how ADA market performed. Nevertheless, on Friday, the ADA Foundation published another tweet, stating that they had fixed the issue. The also marked the release of Cardano 1.5.1 in a healthy state, which is the last major upgrade before the project moves to Ouroboros-BFT protocol. The technical jargon means to provide Cardano blockchain better protection against a 51% attack. Following the upgrade, Cardano – like Ethereum – would eventually switch to PoS.

Extended Bullish Momentum?

Given the fundamentals and the involvement of ZBG, ADA rally looks mildly suspicious. Spot traders seemed to have followed the Cardano fan club for a quick buck, at a time when the rest of the top coins are trending horizontally. The likelihood of an extended bullish momentum is less, therefore. One should exit their long positions on the first sign of reversal (if it comes with a substantial volume). Or, maintaining a stop loss just a pip below the entry points would ensure a lesser loss should the bias reverses.

Quick note: Watch out for the Coinbase-listing-ADA rumor.

[Disclaimer: The author holds 321 ADA tokens in his cryptocurrency portfolio.]